Maine Pay Stub Laws Complete State Guide for Employers

Understanding Maine Pay Stub Laws

Maine pay stub laws ensure employees receive transparent and accurate wage statements every pay period. These rules protect both workers and employers by establishing clear documentation standards. Whether you run a business in Portland or Bangor, staying compliant with Maine’s wage statement laws is essential for smooth payroll operations.

To simplify payroll compliance, use the Pay Stub Generator for instant, error-free stubs. For broader payroll resources, explore our Payroll Guides Section or visit the Massachusetts Pay Stub Laws Guide for comparison.

Maine’s Wage Statement Requirements

According to state regulations, Maine employers must provide written or electronic wage statements every pay period. Each pay stub must clearly display hours worked, gross pay, deductions, and net earnings. Electronic pay stubs are permitted, but employees must be able to print or download them upon request.

To see how Maine compares with other states, check out our Payroll Compliance Guide, which outlines state-specific requirements and employer tips.

Information Required on a Maine Pay Stub

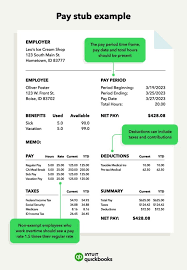

To comply with Maine pay stub laws, employers must include the following details on every wage statement:

- Employee name and identification number

- Employer name and address

- Pay period start and end dates

- Total hours worked, including overtime

- Gross wages earned

- All deductions (taxes, insurance, retirement, etc.)

- Net pay amount

- Year-to-date totals

Employers can easily generate accurate stubs using the Regular Pay Stub Generator, ensuring every required field is included automatically for compliance and accuracy.

Electronic vs. Printed Pay Stubs

Maine law allows employers to issue pay stubs electronically or in print. Electronic versions must be accessible and printable upon request. If an employee prefers paper, employers must accommodate that choice. Offering both options demonstrates transparency and full compliance with Maine pay stub laws.

Learn how to easily create printable, compliant stubs in our How to Create a Pay Stub Online guide.

Common Deductions on a Maine Pay Stub

Employers must clearly list all deductions to maintain transparency and meet state payroll regulations. Typical deductions include:

- Federal and state income taxes

- Social Security and Medicare (FICA)

- Health insurance or benefit premiums

- Retirement plan contributions

- Voluntary deductions or wage garnishments

Accurate documentation of deductions builds employee trust and ensures compliance with Maine pay stub laws. For deeper insight, explore our Payroll Basics for Small Business article.

How to Create a Compliant Pay Stub in Maine

Follow these simple steps to create accurate, compliant pay stubs in Maine:

- Gather employee and company details.

- Record work hours and pay rates.

- Calculate gross earnings and deductions.

- Determine net pay and verify all totals.

- Generate pay stubs instantly with the Pay Stub Generator.

Each stub produced meets Maine’s payroll laws and can be stored for auditing or verification. To personalize your stubs, check our Custom Pay Stub Template Guide.

Penalties for Non-Compliance

Failure to follow Maine pay stub laws can result in penalties from the Maine Department of Labor. Employers who fail to provide accurate or complete wage statements risk fines and legal claims. Maintaining consistent payroll documentation through digital systems helps avoid compliance issues and protects both the business and its employees.

Stay informed about changing rules by reading our State Payroll Law Updates for 2025.

Best Practices for Employers

To ensure smooth payroll operations and ongoing compliance, follow these best practices:

- Issue pay stubs every pay period without exception.

- Retain payroll records for a minimum of three years.

- Verify deductions before releasing payments.

- Provide both digital and paper access to wage statements.

- Regularly review Maine labor law updates.

For multi-state businesses, our Multi-State Payroll Guide explains how to maintain compliance across different jurisdictions.

Conclusion

Following Maine pay stub laws ensures accuracy, transparency, and compliance in every payroll cycle. Legal and detailed wage statements help employers maintain good relationships with employees and protect against potential disputes. Using tools like the Regular Pay Stub Generator and Pay Stub Generator makes the process faster, more reliable, and 100% compliant.

For further payroll insights and compliance strategies, explore our Payroll Guides or the Maine Payroll Resources section.