Create a Pay Stub in Rochester, Minnesota Employer Tips (2025)

Introduction: How to Create a Pay Stub in Rochester, Minnesota

For employers in Rochester, Minnesota, knowing how to create a pay stub in Rochester is essential for accurate payroll and compliance. Pay stubs record employee earnings, deductions, and net pay, ensuring transparency. Using a Minnesota pay stub generator or a Rochester pay stub template guarantees accuracy and legal compliance. For a deeper understanding, check our Minnesota Pay Stub Guide.

Why Employers in Rochester Should Issue Accurate Pay Stubs

Issuing detailed pay stubs builds trust and helps meet Minnesota labor laws. Benefits include:

- Providing proof of income for employees

- Ensuring correct tax and deduction reporting

- Tracking overtime and bonuses

- Reducing payroll mistakes

For compliance tips, explore our Payroll Compliance Guide. Using a pay stub generator ensures professional and accurate results each pay period.

Legal Requirements for Pay Stubs in Rochester

Under Minnesota Statutes Section 181.032, all Rochester employers must provide a written pay statement for each pay period. To properly create a pay stub in Rochester, include:

- Employee and employer names and addresses

- Pay period start and end dates

- Total and overtime hours

- Pay rates for each role

- Gross earnings and all deductions

- Net pay and date of payment

Failing to comply may result in penalties. Review our Payroll Recordkeeping Best Practices for guidance. Using a Rochester pay stub template ensures accuracy and compliance.

Step-by-Step Guide to Create a Pay Stub in Rochester

1. Gather Employee and Employer Information

Collect full employee and company details including names, addresses, and pay rates. For a broader overview, see our Online Pay Stub Creation Guide.

2. Calculate Hours and Earnings

Determine total hours, including overtime and bonuses. Multiply by pay rates to find gross pay. Using a Minnesota pay stub generator simplifies this process.

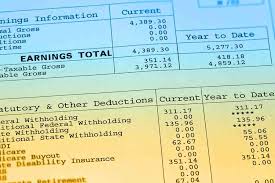

3. Itemize Deductions

Include federal and state taxes, Social Security, Medicare, insurance, and retirement contributions. For more details, visit our Payroll Deduction Breakdown.

4. Calculate Net Pay

Subtract deductions from gross pay to find net pay. Display this clearly for transparency and compliance.

5. Generate Pay Stubs Using Tools

Use a Rochester pay stub template or Minnesota pay stub generator for accuracy and compliance. Learn about automation benefits in our Automated Payroll Benefits article.

Electronic vs Paper Pay Stubs in Rochester

Employers can issue pay stubs electronically or in print. Electronic pay stubs save time and costs, while paper versions help with official recordkeeping. For comparisons, check our Paper vs Digital Pay Stubs guide.

Common Mistakes to Avoid When Creating Pay Stubs

- Omitting overtime or bonuses

- Incorrect tax or deduction calculations

- Missing employee or employer details

- Not providing pay stubs every pay period

To avoid these errors, use a pay stub generator or a Rochester pay stub template. For a checklist, visit our Payroll Error Checklist.

Understanding the Sections of a Pay Stub

- Gross Pay: Total earnings before deductions

- Deductions: Taxes, insurance, retirement contributions

- Net Pay: Amount the employee receives

- Pay Period: Dates covered by the paycheck

Proper formatting makes payroll clear and auditable. Learn more from our Custom Pay Stub Template Guide.

Benefits of Using Online Pay Stub Tools

- Automatic pay and tax calculations

- Compliant, preformatted templates

- Instant PDF downloads for recordkeeping

- Fewer manual errors

Employers save time and maintain accuracy with tools like the Minnesota pay stub generator. For insights on payroll technology, read our Digital Payroll Systems Guide.

Record-Keeping Tips for Employers

- Retain pay stubs for at least three years

- Keep digital backups securely

- Audit pay stubs regularly

- Provide employee access on demand

Stay organized and compliant by following our Payroll Recordkeeping Best Practices.

Conclusion: Best Practices for Employers in Rochester

Knowing how to create a pay stub in Rochester ensures payroll accuracy, compliance, and trust. Use a template or pay stub generator to simplify your payroll process. For more insights, visit our State Payroll Guides and Payroll Compliance Guide.