Ultimate Sioux Falls South Dakota Pay Stub Guide (2025 Edition)How to Make a Legal Pay Stub

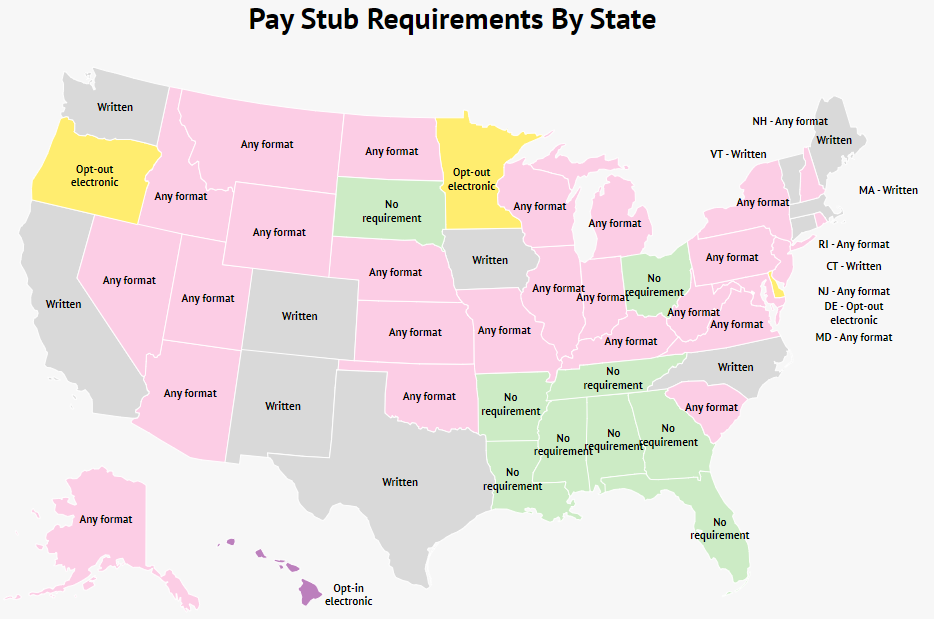

Learn how to create an accurate and legal Sioux Falls South Dakota pay stub in 2025. Discover state payroll laws, deductions, and how to use PStub.com tools for compliance.